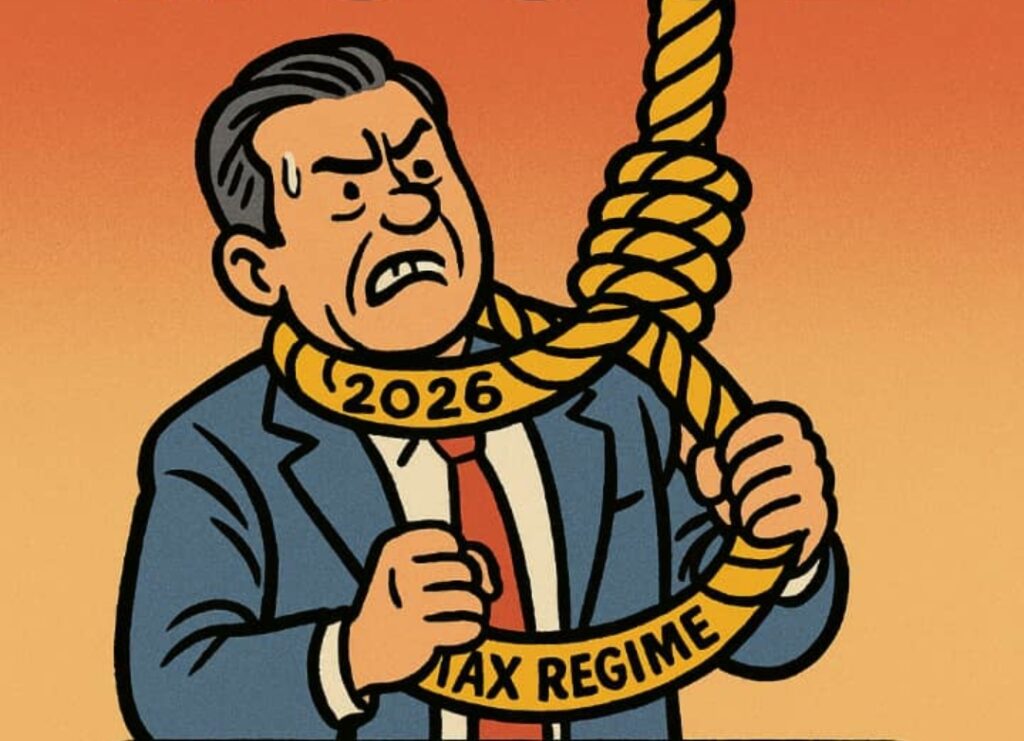

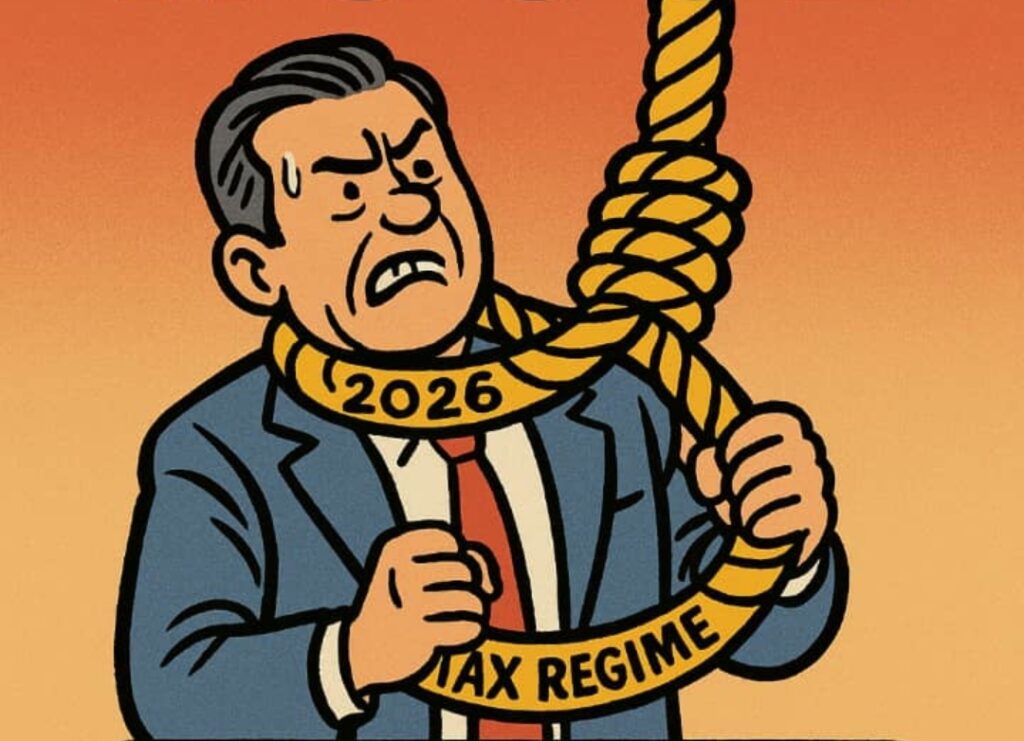

THE TAX NOOSE!

…Pro-poor in Speeches, Pro-Hardship in Taxes

By Ibrahim Alusine Kamara ( Kamalo)

The 2026 Finance Act is set to take effect in the new year having been approved by Parliament. The government projects it will amass NLe 25.9 billion (25.9 trillion old Leones) from domestic revenue and grants. However, it plans to spend NLe 30 billion, leaving a NLe 4.1 billion deficit to be financed through borrowing, yet it brands the Act as “pro‑people.”

Critics, however, flag it as an Act that is far from being people-centred, but a poverty-escalating one in the guise of a revenue generation plan.

The 2026 Finance Act expands the Minimum Alternate Tax and removes Investment Allowance. This means that unlike previously when companies could reduce tax upon purchasing new machines or equipment, by January 2026, they shall now start to pay minimum tax regardless of their business performance. This could trigger layoffs, price hikes, or reduced investment in equipment to recover loss when business is bad.

The Act also increases the Corporate Income Tax from 25% to 30%. For critics, this is the largest tax increase in the Act. When implemented to the letter, companies may simply offset its additional amount of tax paid by freezing salaries, raising prices, or cutting jobs.

The Act calls for a 15% Withholding Tax on rental income to be paid to the government by house owners. With this, landlords will inevitably be pushed to pass the burden onto tenants by increasing rents. The result of this tax could be “high-cost” housing, leading to increasing slum settlement as the only option to avoid homelessness. It also causes residential overcrowding, and in fact, informal rentals.

What aggravates tenants’ plight in the Act is its restoration of the NLe10 Excise Duty per 50kg bag of cement. This tax was previously deleted to mitigate hardship. Now that it is back, the price of cement will eventually rise in 2026, driving up construction costs, and aggravates rents. Even the urge by individuals to build houses will be put in real check.

The Act also increases Non-Resident Withholding Tax from 15% to 20%. This will affect foreign contractors, telecoms, mining, and construction firms—potentially passing costs to consumers.

On fuel per litre, NLe5.0 excise duty is increased. Critics view this tax as most deadly in the entire Act. The cost of fuel determines transportation costs, and any additional tax on it, coupled with the new Vehicle Circulation Levy (NLe 500 for cars, NLe 200 for bikes) will automatically spike transport fares and commodity prices, including services costs.

The Act’s new levy on commercial boats and fishing vessels—US$1,000, or US$500 each per annum depending on the category one belongs, will have negative effects on the entire fishing sector. This tax is an excruciating burden on boat and vessel owners because of the exchange rate pressure. To ease the burden on them, therefore, they will raise fish prices, which will hurt protein intake for low‑income families.

The Act then triggers the daily survival “checker” and “killer trap”— imposing a 35% Import Tax on several food items, including cooking oil, eggs, tomato paste and Sardines.

The 2026 Finance Act may be a big bang for the government with considerable financial gains, but private sector workers, and consumers will carry the heavy, thorny cross.

Under President Maada Bio, Sierra Leone operates on a bloated wage bill, and being pitched in high inflationary trends, high cost of living, weak energy supply but high electricity tariffs, high housing rent, and high cost of education, even as it is the flagship programme of government. Most of Sierra Leonean households face dire socioeconomic circumstances, toiling to eke out a daily living. The reintroduction of taxes once removed, and the introduction of new others is diametrically opposed to a happy living.

In the second week of January 2025, the price of staple food rice was adjusted. A bag of parboil rice was reduced from NLe960 to NLe840. As time passed by, this cost underwent intermittent adjustment, leaving a 50kg bag of rice now to be sold in the Western Area between NLe650 and NLe750 depending on the variety.

Also in March, 2025, a fixed pricing formula for cement was introduced after thorough consultation with key importers and local cement producers. This was aimed at stabilizing the hiking cost. While these moves slightly cushioned the plight of Sierra Leoneans, the 2026 Finance Act is now emerging as the aggressive spoiler.

In 2026, the nation may face reduced investment and increasing joblessness, soaring inflation, plummeting purchasing power, higher housing costs, neck-breaking communication tariffs, and more expensive construction and building materials—the list goes on—as a result of a purported “pro-people” Finance Act.

It must be born in mind that when the purchasing power of people is ruined, lower demand sets in. This can cause slower business growth, and at worse, closure, bringing onto the masses more suffering and deepening poverty. Even projects like Feed Salone (food security) will likely be undermined by the same fiscal measures meant to fund them.

Meanwhile, the argument that “almost 50–60% of condiments used daily are now produced locally” to meet consumer demand could not be said to be true for Sierra Leone with weak local supply. “Protecting local manufacturing” to limit reliance on foreign goods through the imposition of heavy import taxes when the country cannot produce half of its consumables is not protection of local production, it is mockery of the people, and a ripoff. In fact, when the importation of goods is too expensive due to high taxes, scarcity always creeps in— business people may decide to suspend importation, or cut down the quantity imported.

Emphatically, higher taxes ravage businesses due to huge running costs. While the government cites revenue needs, critics argue that without parallel wage adjustments or social safeguards, the 2026 Finance Act will be nothing rather than a punishment on the citizens.