The People vs. the Finance Act 2026

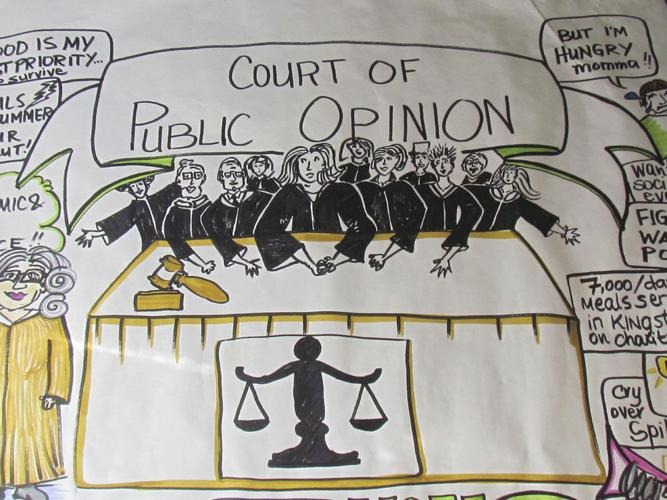

In the court of public opinion, the Finance Act 2026 stands accused not of bad economics alone, but of cruel timing, social blindness, and misplaced priorities.

To the average Sierra Leonean—market woman, bike rider, private-sector worker, tenant, fisherman, or struggling graduate—this Act does not read like a “pro-people” document. It reads like a punishment notice.

Charge One: Taxing the Poor to Fix the State

The people’s court is unimpressed by government projections of NLe 25.9 billion in revenue. The public asks: “If revenue keeps increasing every year, why is our suffering also increasing?”

In the public mind, a government that raises taxes on fuel, food, rent, cement, transport, and fishing tools, all at once, is not broadening the tax base; it is broadening poverty.

Charge Two: Fuel as the Silent Executioner

The excise duty on petrol and diesel is viewed by the public as the deadliest weapon in the Act. Sierra Leoneans understand one basic truth: When fuel goes up, everything goes up.

In the court of public opinion, any government that taxes fuel during high inflation is knowingly triggering a chain reaction, including higher transport fares, higher food prices, higher rents, while pretending innocence.

Charge Three: Housing and Food on Trial

Tenants already gasping for breath see the rental withholding tax hike as a direct eviction notice, even before landlords speak. The people predict overcrowding, informal settlements, and quiet homelessness.

The 35% import duty on basic food items—tomato paste, Maggi, eggs, bottled water—is judged harshly. The public’s verdict is blunt:

“You are taxing how we survive, not how we enjoy.”

In the people’s court, this is seen as a policy that criminalises poverty and normal eating.

Charge Four: Killing Jobs While Speaking Growth

Workers see the MAT expansion and the corporate tax hike not as attacks on companies, but as future attacks on jobs. The public knows how this story ends: layoffs, salary freezes, casualisation, and price hikes.

In this court, the argument that “companies will absorb the cost” is laughed out of the room.

Charge Five: Policy Without Protection

Perhaps the most damning judgment is this: The Finance Act 2026 offers no visible protection—no wage adjustment, no transport subsidy, no rent control cushion, no food relief — for the very people asked to bear the burden.

To the public, this signals a government comfortable with sacrifice, as long as it is not its own.

🧑🏾⚖️ Public Verdict

In the court of public opinion, the Finance Act 2026 is found:

Guilty of being anti-timing

Guilty of being socially detached

Guilty of escalating hardship

Guilty of taxing survival instead of luxury

Guilty of calling pain “reform”

Sentence, according to the people:

Widen inequality, deepen resentment, weaken trust in governance, and inflame public anger.

Unless amended, softened, or matched with real social buffers, the Finance Act 2026 will be remembered not for the revenue it raised but for the hope it crushed.

In the people’s court, the gavel has already fallen.